Elysys Data Migration Manual

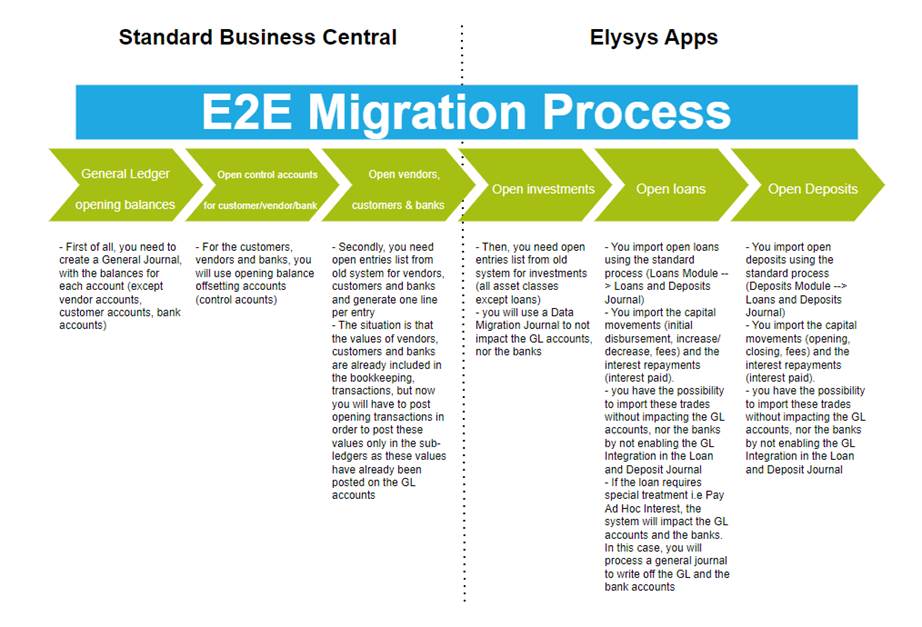

This document describes the approach for data migration in Elysys Apps and for Microsoft Dynamics Business Central. Three types of transactions can be managed within the system:

-

Standard Business Central transactions:

-

General Ledger opening balances,

-

Open control accounts for vendors, customers, bank accounts,

-

Open vendors, customers, bank accounts,

-

-

Elysys Apps transactions:

-

Open investments,

-

Open loans,

-

Open deposits.

-

The data migration process (transactions/ opening balances) is done at

the company level !

Opening balances for GL accounts, vendors, customers and banks

We recommend that you migrate opening balances in steps, in the following order.

-

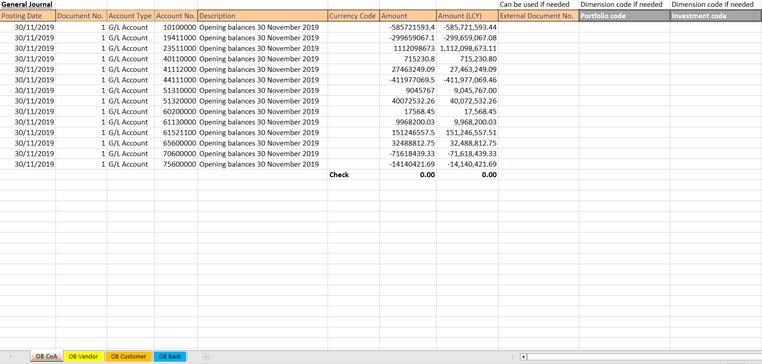

Migrate general ledger opening balances without using the general ledger account subledgers. Use specific opening balance offsetting accounts (control accounts), one set up for each subledger. Set up the offsetting accounts (control accounts) to enable direct postings.

-

Migrate open customer ledger entries, vendor ledger entries and bank entries.

Then post your balance forward with a date at your convenience (30/11/2019).

Secondly, you need open entries list from your old system for vendors, customers and banks and generate one line per entry in the General Journal in case you need to keep the historic.

The situation is that the values of your customers, banks and vendors are already included in your bookkeeping transactions, but that now you will have to post opening transactions in order to post these values only in the sub-ledgers as these values already have been posted on G/L accounts.

Two options can be done:

-

One line per vendor per invoice. You will use as a balance account, the same vendor posting group to write-off this G/L account.

-

Or the balance of the vendor.

Opening balances for investments

At this stage, the open entries list from old system for investments (all asset classes except loans) is required.

You will use a Data Migration Journal to process the opening balances (or historical transactions) to not impact the GL accounts, nor the banks. This is because the GL accounts and the banks should have been migrated in the previous step.

Opening balances for loans

We recommend following the following steps to manage the loan historical transactions:

-

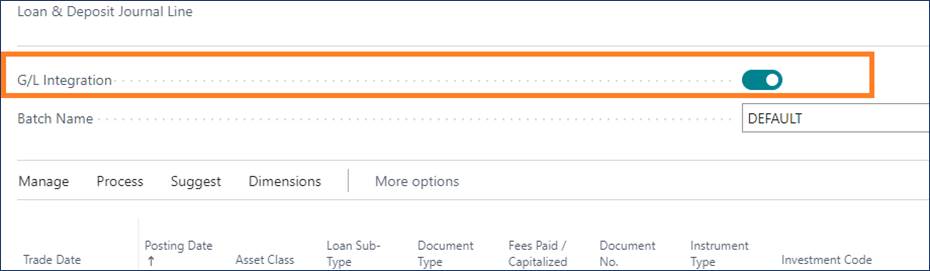

You import the capital movements (initial disbursement, increase/ decrease, fees) and the interest repayments (interest paid). You import open loans using the standard process (Loans Module Loans and Deposits Journal).

-

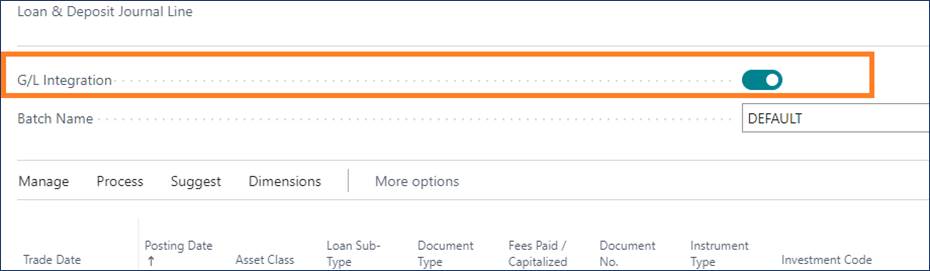

You have the possibility to import these trades without impacting the GL accounts, nor the banks by switching off the GL Integration in the Loan and Deposit Journal,

- If the loan requires special treatment i.e Pay Ad Hoc Interest, the system will impact the GL accounts and the banks. In this case, you will process a general journal to write off the GL and the bank accounts.

Opening balances for deposits

We recommend following the following steps to manage the deposit historical transactions:

-

You import the capital movements (opening, closing, fees) and the interest repayments (interest paid). You import open deposits using the standard process (Deposits Module Loans and Deposits Journal)

-

You have the possibility to import these trades without impacting the GL accounts, nor the banks by not enabling the GL Integration in the Loan and Deposit Journal.

Journals & Posting procedures

Data Migration Journal

Go to: Home ➔ Toolkit ➔ Journal➔ Button: Data Migration Journal (while using the Elysys Back Office Profile)

An excel template will be provided to fill in the following information, related to each investment:

-

Insert Opening Balances as of 30/11/2019

- Add the Amount ICY/PCY/LCY.

-

For the Opening Balance, please use the Document Type “Purchases” for all investments which have a Long position and “Sales” for all investments which have a Short position @ 30/11/2019.

- The “Rules” sheet defines the Asset Classes & Document Types which are allowed.

-

The Portfolio Code, Investment Code, Bank Account must match with existing Codes set up

Investments Revaluation

Import the Market Price for each investment to be revalued

Go to: Home ➔ Periodic Activities ➔ Button: Portfolio Revaluation

The Portfolio Revaluation journal will be used to revalue the investments and this process will impact the GL and the bank accounts.

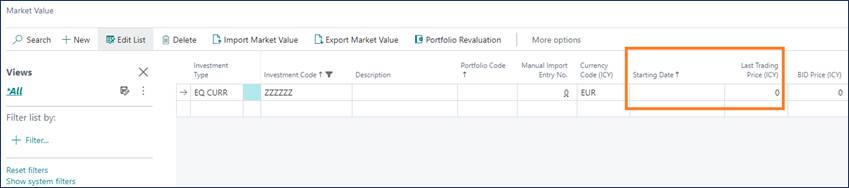

As a prerequisite, you must insert the Market Price (in the investment currency) and the last trading date in the Market Value table before running the revaluation.